Manchester City: Premier League legal case verdict announced on APT rules

Both parties welcomed the 175-page findings

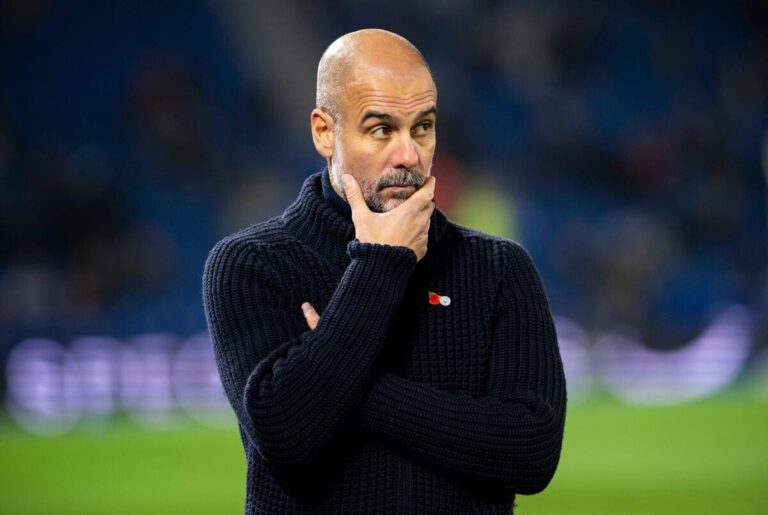

Manchester City and the Premier League have both claimed victory in their legal case over associated party transaction (APT) rules.

A tribunal has reached a verdict over the dispute, which is related to sponsorship regulations around clubs and other companies which may be linked to them.

The panel found that the exclusion of shareholder loans from APT calculations and the process by which clubs were informed of “benchmarking” decisions were unlawful.

The Premier League says the tribunal “endorsed the overall objectives, framework and decision-making of the APT system”.

Table of Contents

Man City Premier League APT case

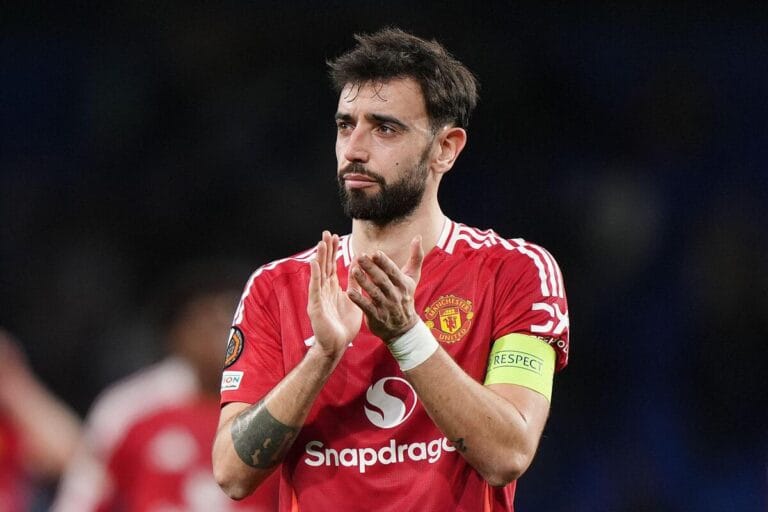

The Premier League’s case, which overcame many of City’s challenges, was backed by Arsenal – who have borrowings of more than £200 million made of shareholder loans – as well as Manchester United, Liverpool, West Ham, Brentford, Bournemouth, Fulham and Wolves.

According to the panel, £1.5 billion of the £4bn in total borrowing across the Premier League is in loans from club owners and shareholders.

APT rules were introduced in December 2021 after the Saudi-led takeover of Newcastle United and altered in February 2024.

How has APT worked?

Deals are independently assessed for “fair market value” under rules aimed at strengthening the competitiveness of the Premier League by stopping clubs from inflating commercial deals with companies linked to their owners.

Premier League decisions on deals struck by City with their stadium and shirt sponsor, Etihad, and First Abu Dhabi Bank have been dismissed, while the club could claim compensation.

City’s legal case was led by Lord Pannick, who is also leading their defence against 115 charges for alleged breaches of Premier League financial rules, which is separate from and unrelated to the APT case.

The Times described the verdict as a “landmark ruling” with potentially “huge ramifications” for the Premier League, adding that there will be “huge concern” among clubs who rely heavily on shareholder loans.